Should I Buy or Sell First? What’s Less Stressful?

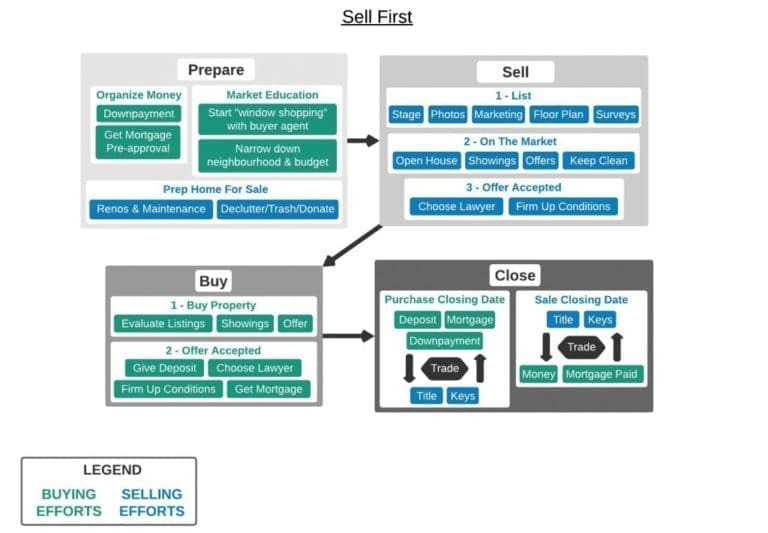

There isn’t a magic answer, however, there is a formula for making the right choice for you. Let’s break down the 4 major steps involved in buying/selling, so we can pinpoint the main stresses, and sift out all the other “annoyances”.